Germany: Fund industry grows by 6 per cent

- Equity funds with record assets

- Bond funds with highest sales since 2012

- Balanced funds and property funds with outflows

- Decline in new business for Spezialfonds

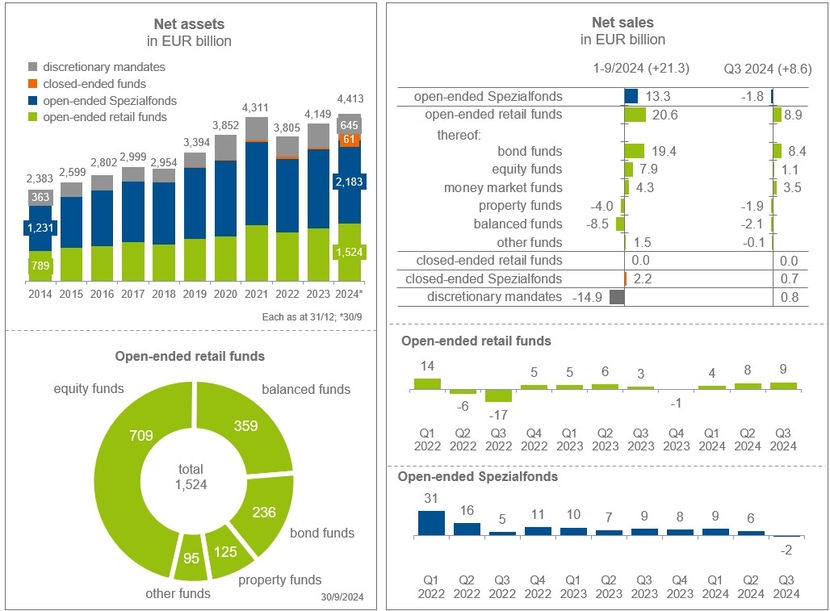

The fund industry manages a record EUR 4,413 billion in assets for investors in Germany as at the end of September. This is an increase of over 6 per cent since the beginning of the year (EUR 4,149 billion). At EUR 2,183 billion, the majority is accounted for by open-ended Spezialfonds for institutional investors. These are primarily retirement pension schemes (EUR 768 billion) and insurers (EUR 536 billion). The fund companies manage EUR 1,524 billion in open-ended retail funds, EUR 645 billion in mandates and EUR 61 billion in closed-ended funds.

In terms of assets under management in retail funds, equity funds are clearly in the lead with a record volume of EUR 709 billion. Over the last ten years (30 September 2014: EUR 278 billion), their assets have increased by an average of 9.8 per cent p.a. This is followed by balanced funds with EUR 359 billion. The proportion of equity-focused

balanced funds has risen from 24 to 34 per cent since September 2014, while the proportion of balanced products has fallen from 52 per cent to 42 per cent. Bond-focused balanced funds still account for 23 per cent. Bond funds manage EUR 236 billion; at EUR 72 billion, funds that invest in bonds with a remaining term of up to three years (short-duration bond funds) are the largest group in terms of volume. The net assets of property funds amount to EUR 125 billion. Money market funds account for EUR 51 billion.

In the first nine months of the year, the industry received net new money totalling EUR 21.3 billion. Open-ended retail funds accounted for EUR 20.6 billion of this, compared to EUR 14.0 billion in the same period last year. The higher inflows are primarily due to the strong new business of bond funds. They received EUR 19.4 billion. Short-duration bond funds alone received EUR 13.8 billion. Most recently, bond funds received a higher total inflow of EUR 20.5 billion in the same period of 2012. Equity funds received a net amount of EUR 7.9 billion until the end of September. While equity ETFs recorded EUR 13.3 billion in new money, actively managed funds saw an outflow of EUR 5.4 billion. Money market funds recorded EUR 4.3 billion inflow. Outflows from balanced funds totalled EUR 8.5 billion. EUR 4.0 billion flowed out of property funds. Almost half is attributable to the third quarter. Investors who bought their property funds after 21 July 2013 had to wait a twelve-month notice period before doing so.

New business from open-ended Spezialfonds is significantly lower than in the same periods of the previous years. While they received a net amount of EUR 13.3 billion from the beginning of January to the end of September 2024, inflows in the same period of the previous year were almost twice as high at EUR 25.9 billion. In the first nine months of 2022, Spezialfonds even received EUR 51.7 billion. One reason for the decline in new business is the return of interest rates. In the phase of falling interest rates and during the zero-interest phase, many insurers sold fixed-interest bonds with long maturities, for example, and used some of the realised price gains to finance the build-up of the so-called “Zinszusatzreserve” (additional interest reserve) to meet guarantee commitments. Apparently, they have invested the rest of the money from their sale of bonds mainly in Spezialfonds. Due to the return of interest rates in 2022, this effect no longer applies and many insurers are keeping their remaining fixed-interest bonds in their portfolios until maturity. For other investor groups of Spezialfonds, such as retirement pension schemes, increased capital needs, for example for payouts to the increased proportion of pensioners, are likely to be a reason for the reluctance to make new investments.

Download Press release (PDF)